unemployment tax break refund mn

On September 13th the. Paul MN 55145-0010 Mail your property tax refund return to.

Unemployment Compensation Are Unemployment Benefits Taxable Marca

The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up.

. Paul MN 55145-0020 Mail your tax questions to. 651-296-3781 or 1-800-652-9094 Email. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income.

Why are you getting this. State lawmakers managed to pass the law the day before the April 30 deadline to submit taxes but alas some businesses had already paid their quarterly taxes at the higher rate. In the latest batch of refunds announced in November however the average was 1189.

Individualincometaxstatemnus Business Income Tax Phone. About 560000 tax returns are impacted by the change which was the last bill to clear the state capitol during special sessionGov. You had to qualify for the exclusion with a modified adjusted gross income of less than 150000.

Current Tax Law Changes. No major tax bill was enacted during the regular 2022 legislative session which ended May 23. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month.

The website also states that they sent letters to taxpayers that need to amend their state return. If a credit cannot be used a refund will be paid. Without that law Minnesota businesses were set to suffer a 30 increase in their unemployment taxes triggered when the fund is below a certain threshold.

For step-by-step instruction to request a credit adjustment and refund. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. The state of Minnesota had originally taxed the full amount of unemployment that you received in 2020.

Unemployment Income Rules For Tax Year 2021. For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today. Individual Income Tax Phone.

Earlier in the session two law. This means that you dont have to pay federal tax on the first 10200 of your unemployment benefits if your adjusted gross income is less than 150000 in 2020. They have about 540000 refunds to issue and expect to do 1000 per week so it may take a while.

Unemployment Federal Tax Break. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. Minnesota Law 268057 Subd7.

Unemployment 10200 tax break. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. The latest COVID-19 relief bill gives a federal tax break on unemployment benefits.

Minnesota Department of Revenue Mail Station. Base Tax Rate for 2022 from 050 to 010. The new law reduces the.

If you received unemployment in 2020 and filed BEFORE Minnesota changed their law of taxing the unemployment income you may be getting a letter informing you that you will be receiving an additional refund. When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. For those who filed 2020 tax returns before Congress passed an exclusion on the first 10200 in unemployment benefits heres how.

The 150000 income limit is the same whether you are filing single. Additional Assessment for 2022 from 1400 to 000. Minnesota Department of Revenue Mail Station 0020 600 N.

Refunds set to start in May Those who filed 2020 tax returns before Congress passed an exclusion on the first 10200 in unemployment benefits could be getting a. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. Employers that overpay their unemployment insurance tax amount due for a quarter can request a credit adjustment within four years from the date the tax payment was originally due.

Where S My Refund Minnesota H R Block

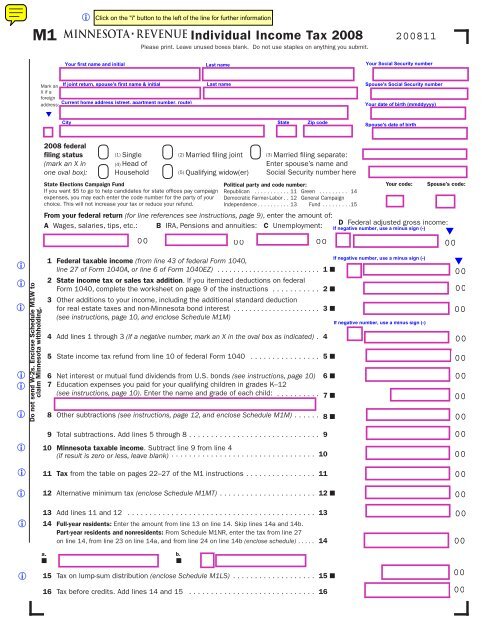

2008 M1 Individual Income Tax Return Minnesota Department Of

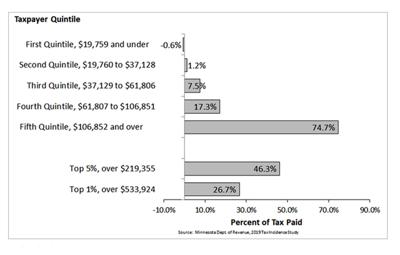

Is Minnesota S Tax System Unfair State Southernminn Com

Minnesota Guidance On Federal Unemployment Compensation Exclusion

When Will Irs Send Unemployment Tax Refunds Kare11 Com

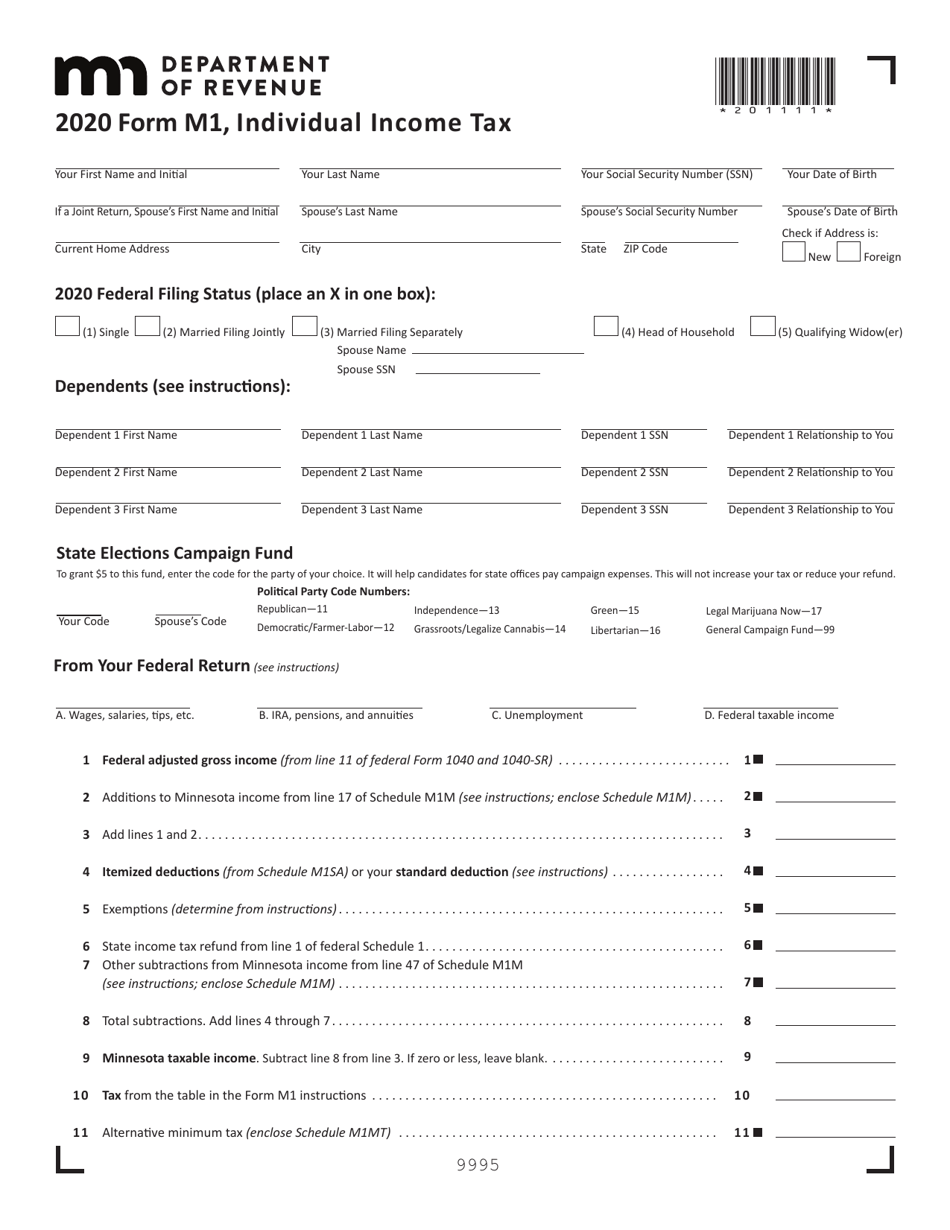

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

When Should Minnesotans Expect Tax Refunds Passed In The State Budget

Form M1 Download Fillable Pdf Or Fill Online Individual Income Tax 2020 Minnesota Templateroller

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned

Is Minnesota S Tax System Unfair State Southernminn Com

Minnesota W4 Form 2021 W4 Tax Form Tax Forms Filing Taxes

Details On Recouping Ui Taxes Frontline Worker Bonuses Minnesota Chamber Of Commerce

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Minnesota Department Of Revenue Facebook

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned